All Categories

Featured

Table of Contents

[/image][=video]

[/video]

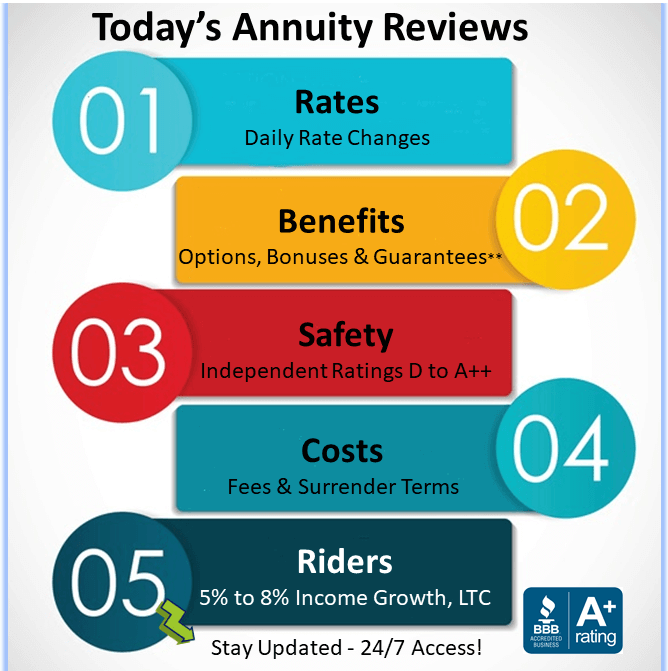

Thinking passion rates stay solid, even higher assured rates might be possible. Making use of a laddering method, your annuity profile renews every couple of years to take full advantage of liquidity.

Rates are assured by the insurance business and will certainly neither enhance nor reduce over the chosen term. We see passion in temporary annuities providing 2, 3, and 5-year terms.

Riversource Annuity Complaints

Which is best, basic rate of interest or intensifying passion annuities? Most insurance policy companies only offer intensifying annuity policies.

All of it depends upon the hidden rate of the repaired annuity contract, of course. We can run the numbers and compare them for you. Let us know your intents with your passion income and we'll make suitable referrals. Experienced fixed annuity capitalists understand their premiums and passion gains are 100% obtainable at the end of their picked term.

Unlike CDs, repaired annuity policies permit you to withdraw your interest as revenue for as long as you wish. And annuities offer greater rates of return than mostly all comparable financial institution tools used today. The other piece of good news: Annuity prices are the highest possible they've been in years! We see dramatically more interest in MYGA accounts currently.

There are several very rated insurance coverage companies striving for down payments. There are several widely known and highly-rated business using affordable returns. And there are companies specializing in score annuity insurance coverage business.

These grades go up or down based on a number of factors. Insurance business are commonly secure and safe and secure establishments. Extremely couple of ever before fall short given that they are not enabled to provide your deposits like banks. There are numerous rated at or near A+ providing some of the most effective yields. A couple of that you will see above are Dependence Standard Life, sis companies Midland and North American Life, Americo, Oxford Life, American National, Royal Neighbors, Pacific Guardian Life, Athene, Sagicor, Global Atlantic, and Aspida to call a few.

See this brief video clip to comprehend the resemblances and differences in between the 2: Our customers buy dealt with annuities for several factors. Security of principal and guaranteed rate of interest prices are definitely two of the most vital elements.

Annuity What Happens When You Die

These plans are very versatile. You may wish to defer gains currently for bigger payments throughout retired life. We offer products for all circumstances. We help those needing instant passion income currently in addition to those preparing for future revenue. It is very important to note that if you require income currently, annuities work best for those over age 59 1/2.

We are an independent annuity brokerage with over 25 years of experience. We help our customers secure in the highest yields feasible with secure and secure insurance coverage companies.

Recently, a wave of retiring baby boomers and high passion prices have actually helped fuel record-breaking sales in the annuity market. From 2022 to 2024, annuity sales topped $1.1 trillion, according to Limra, a global research study organization for the insurance sector. In 2023 alone, annuity sales raised 23 percent over the prior year.

Masterdex 10 Annuity Allianz

With even more possible rates of interest cuts coming up, uncomplicated set annuities which tend to be less difficult than various other options on the market may end up being much less appealing to customers because of their winding down rates. In their location, other selections, such as index-linked annuities, might see a bump as consumers seek to record market growth.

These rate hikes provided insurance coverage firms area to supply even more attractive terms on repaired and fixed-index annuities. "Passion prices on repaired annuities also increased, making them an appealing investment," states Hodgens. Even after the supply market recoiled, netting a 24 percent gain in 2023, lingering worries of an economic downturn kept annuities in the limelight.

Other elements additionally contributed to the annuity sales boom, including even more banks now providing the products, claims Sheryl J. Moore, CEO of Wink Inc., an insurance market research study firm. "Customers are becoming aware of annuities greater than they would certainly've in the past," she claims. It's likewise easier to get an annuity than it utilized to be.

"Literally, you can use for an annuity with your representative with an iPad and the annuity is authorized after completing an on-line type," Moore says. "It made use of to take weeks to obtain an annuity with the concern process." Fixed annuities have actually moved the current development in the annuity market, standing for over 40 percent of sales in 2023.

Limra is expecting a pull back in the popularity of dealt with annuities in 2025. Sales of fixed-rate deferred annuities are expected to drop 15 percent to 25 percent as rate of interest decrease. Still, dealt with annuities have not lost their glimmer fairly yet and are using traditional capitalists an appealing return of even more than 5 percent in the meantime.

Which Is Better Ira Or Annuity

There's also no requirement for sub-accounts or profile management. What you see (the guaranteed rate) is what you get. At the same time, variable annuities typically come with a shopping list of costs mortality expenditures, management expenses and investment administration costs, to name a couple of. Fixed annuities maintain it lean, making them a less complex, more economical choice.

Annuities are complicated and a bit various from various other monetary products. (FIAs) damaged sales records for the third year in a row in 2024. Sales have actually virtually increased since 2021, according to Limra.

Caps can differ based on the insurer, and aren't most likely to stay high forever. "As rate of interest have actually been coming down lately and are anticipated to find down better in 2025, we would certainly prepare for the cap or involvement prices to additionally come down," Hodgens states. Hodgens expects FIAs will remain appealing in 2025, but if you remain in the market for a fixed-index annuity, there are a couple of things to keep an eye out for.

In concept, these crossbreed indices intend to smooth out the highs and lows of an unstable market, however in reality, they have actually typically fallen brief for consumers. "Several of these indices have returned little bit to absolutely nothing over the past number of years," Moore says. That's a tough tablet to swallow, considering the S&P 500 uploaded gains of 24 percent in 2023 and 23 percent in 2024.

The more you research study and store about, the much more most likely you are to locate a trustworthy insurer going to offer you a respectable price. Variable annuities once dominated the marketplace, however that's altered in a big means. These items endured their worst sales on record in 2023, going down 17 percent compared to 2022, according to Limra.

Individual Annuities - Financial Professional

Unlike dealt with annuities, which use drawback protection, or FIAs, which balance safety and security with some growth potential, variable annuities provide little to no defense from market loss unless riders are tacked on at an included expense. For financiers whose leading priority is maintaining funding, variable annuities just don't determine up. These products are likewise notoriously complicated with a history of high fees and substantial abandonment charges.

But when the market collapsed, these bikers became obligations for insurance firms because their guaranteed worths went beyond the annuity account worths. "So insurance coverage companies repriced their bikers to have much less eye-catching attributes for a greater rate," says Moore. While the market has made some efforts to boost openness and lower costs, the product's past has soured lots of consumers and monetary experts, that still see variable annuities with hesitation.

Tsp Annuity Interest Rate

RILAs use consumers much greater caps than fixed-index annuities. How can insurance policy firms manage to do this?

For instance, the vast array of crediting methods made use of by RILAs can make it challenging to compare one item to an additional. Greater caps on returns also feature a trade-off: You tackle some danger of loss past a set floor or buffer. This buffer shields your account from the very first part of losses, normally 10 to 20 percent, yet after that, you'll shed money.

Table of Contents

Latest Posts

F And G Annuities And Life

Annuity Lawsuit

Single Premium Deferred Fixed Annuity

More

Latest Posts

F And G Annuities And Life

Annuity Lawsuit

Single Premium Deferred Fixed Annuity